Business Conditions Survey

April 2020

NABE Survey Results the Worst Since the Global Financial Crisis in

Most Areas; Three-Month Outlook Darkening Further

The April 2020 NABE Business Conditions Survey report presents the responses of 107 NABE members to a survey conducted April 13-16, 2020, on business conditions in their firms or industries, and reflects first-quarter results and the near-term outlook.

COMMENTS: “The April 2020 NABE Business Conditions Survey represents a very different world than the one we inhabited during the last survey in January,” said NABE President Constance Hunter, CBE, chief economist, KPMG. “The outlook for inflation-adjusted gross domestic product (real GDP) in 2020 reversed sharply, with 86% of respondents expecting a contraction and only 14% predicting some positive growth.”

“Respondents report that last quarter was the worst since the global financial crisis for sales, profit margins, prices, and capital spending,” added NABE Business Conditions Survey Chair Megan Greene, senior fellow, Harvard Kennedy School. “Compared to the outlook three months ago, respondents in the April survey report huge declines in the outlook for the next three months for each of these measures, as well as for wages and employment.

“Nearly three-quarters of respondents, including 93% of goods-producers, report that their near-term outlook is worse than it was a month earlier,” continued Greene. “A third of respondents say their firms’ operations have been ‘severely impacted,’ including a few firms that have had a ‘full suspension of operations.’ Nevertheless, three-quarters of respondents expect their firms can stay afloat for longer than six months without federal assistance. Thirty percent of respondents expect to resume normal business operations within five to eight weeks, but nearly as many expect it will take three to six months.”

HIGHLIGHTS

• The panel’s consensus outlook for the U.S. economy, measured by year-over-year growth in inflation-adjusted gross domestic product (real GDP), reversed sharply in April compared to the previous survey outlook. A large majority of panelists (86%) expects negative growth: 70% expect GDP to decline 2.0% or less over the coming year, while about 14% of respondents expect some positive growth through the end of 2020, although most of these panelists expect GDP growth of 1.0% or less.

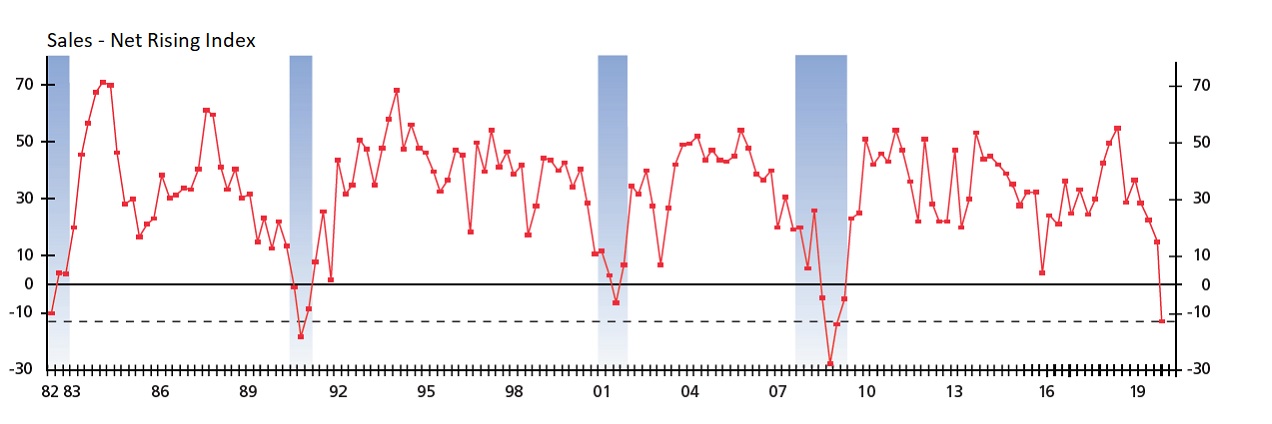

• For the first time since the 2007-2009 recession, more respondents reported falling sales than rising sales at their firms in the previous three months. The Net Rising Index (NRI) for sales—the percentage of panelists reporting rising sales minus the percentage reporting falling sales—plunged 28 points, from a positive 15 in the January survey to -13, out of a possible range of -100 to 100. The NRI for anticipated sales increases over the next three months is -55, down 85 points from January’s reading.

• Significantly more respondents report falling profit margins at their firms in the first quarter of 2020 than in the previous decade. The NRI for profit margins fell 29 points to -29. Overall, the NRI for profit margins expected over the next three months declined 77 points from January to -57 in April, turning decidedly negative across the four industry sectors. Most notably, the NRI for goods-producers declined 121 points.

• For the first time since 2012, the NRI for prices charged turned negative, registering -5 in April. Expectations for price declines over the next three months jumped—from 2% of respondents in January to 34% in April. The NRI fell by 54 points, from 26 to -28. More respondents from all sectors expect falling prices than rising prices at their firms over the next three months. The NRI ranges from -25 in the services sector to -40 in the finance, insurance, real estate (FIRE) sector.

• Twenty-four percent of panelists report that materials costs declined, pushing the NRI below 0 for the first time in four years. The NRI for expected materials costs also declined, by 54 points—from 33 in January to -21 in April. Expectations for decreases in materials costs are the sharpest among goods-producers, with 45% of respondents in that sector predicting cost declines in the next three months.

• Hiring at respondents’ firms, on net, was slightly positive the first quarter (Q1) of 2020; the NRI for employment is 2. Looking ahead to Q2 2020, 32% of respondents anticipate that employment at their firms will decline, while just 1% expect increases.

• The share of respondents reporting skilled and unskilled labor shortages declined significantly from the January 2020 survey results; both measures decreased by more than half. The share of respondents reporting skilled labor shortages is 21%, down from 43% in the previous survey; the share reporting shortages in unskilled labor fell to 8% from 18%. The percentage of respondents reporting no shortages rose to 52%, the highest level for this measure since the July 2017 survey.

• The NRI for capital spending declined notably—from 18 in January to -4 in April—the first negative reading since 2009. The NRIs for all sectors are lower compared to January data. The forward-looking NRI for capital spending also declined—from 21 in January to -40 in April—with half of respondents indicating expected capital spending will decline in the next three months.

• Sixty-three percent of respondents indicate their firms have imposed a hiring freeze in response to challenges from the COVID-19 virus. In addition, 34% of companies have shut down operations in whole or in part, 31% have furloughed employees, and 17% have terminated part of their workforce.

• Almost three-quarters of respondents report that their near-term outlook (for the next three months) is “worse” compared to one month ago. Ninety-three percent of respondents from goods-producing firms and 85% of those from transportation, utilities, information, communications (TUIC) firms indicate their near-term outlook has worsened. Twenty-three percent report their near-term outlook is “about the same,” including 31% of respondents from the services sector industry. Only 3% of respondents report a “better” outlook—with all of those coming from the services sector.

• Overall, one-third of respondents report their operations are “severely impacted,” including 2% that report a “full suspension of operations.” About half (52%) of respondents indicate their operations are “moderately impacted,” while 14% state they are not impacted. Respondents from the services sector report the broader spectrum of impacts, ranging from “full suspension” (2%) to “not impacted” (17%).

• Three-quarters of respondents indicate their firms can “stay afloat” for longer than six months without federal assistance. No respondents report their firms would fail in less than 5-6 weeks.

• Forty-six percent of all respondents replied “no” to seeking federal assistance through the recently passed stimulus packages. “Don’t know” is the second-most common answer.

• Thirty percent of respondents expect to resume normal business operations within 5-8 weeks, but nearly as many expect it will take 3-6 months. Respondents from the goods-producing sector, however, are more bullish than those from other sectors, with half of goods-producers suggesting that normal operations will resume in six weeks or less, compared to less than one-third of respondents from other sectors. Sixteen percent of respondents indicate that normal operations would require longer than six months to resume at their firms.

• Over half of respondents expect the official U.S. unemployment rate will be between 6% and 9.9% one year from now; 28% of respondents anticipate that the U.S. unemployment rate will be 10% or higher in April 2021. One-fifth expect the rate will be between 3% and 5.9%.

• Approximately one out of three respondents “somewhat” or “strongly” agree that the COVID-19 experience will lead to more geographically flexible hiring and working arrangements, such as more office locations, in the future.

DOWNLOAD FULL SURVEY REPORT (Members only - sign-in required)